Watching the Stock Market? Check the Value of Your Home for Good News.

While watching the stock market recently may have started to feel pretty challenging, checking the value of your home should come as welcome relief in this volatile time. If you’re a homeowner, your net worth got a big boost over the past few years thanks to rising home prices. And that increase in your wealth came in the form of home equity. Here’s how it works.

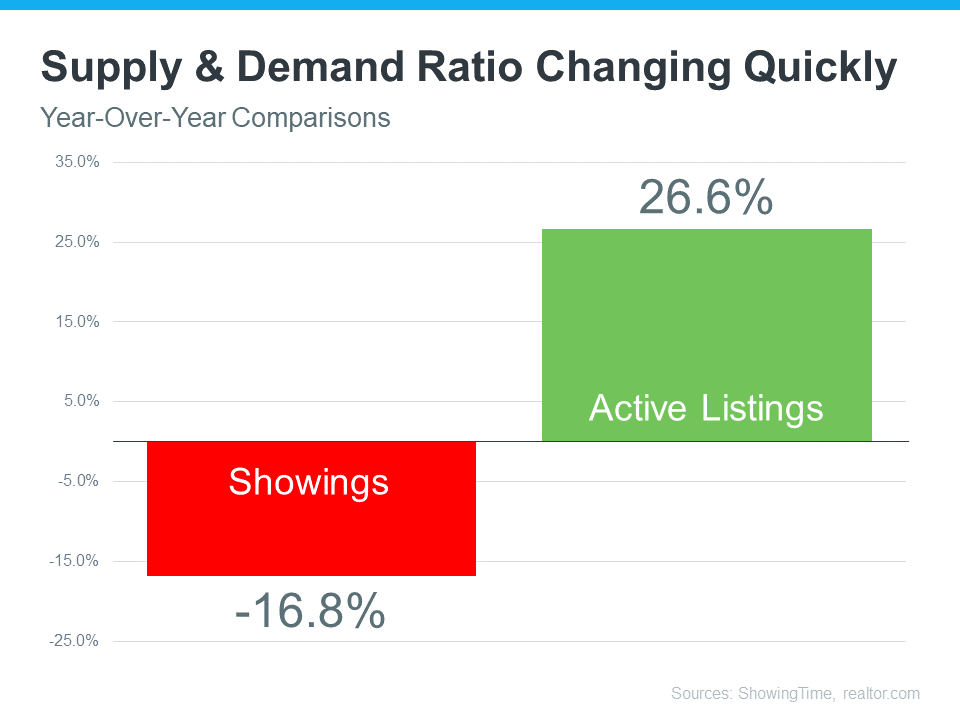

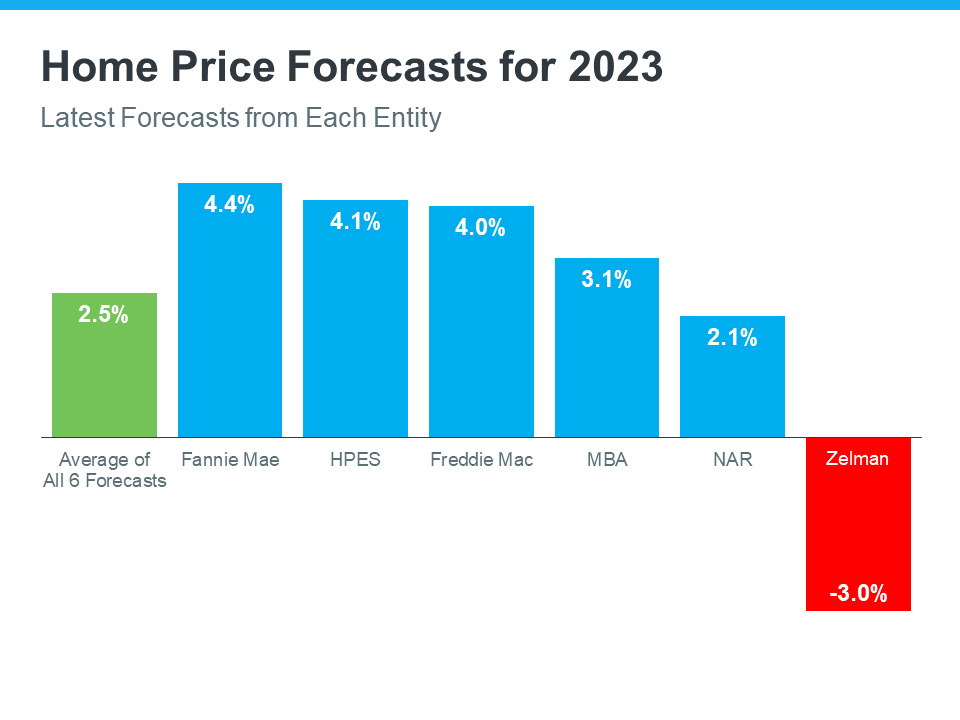

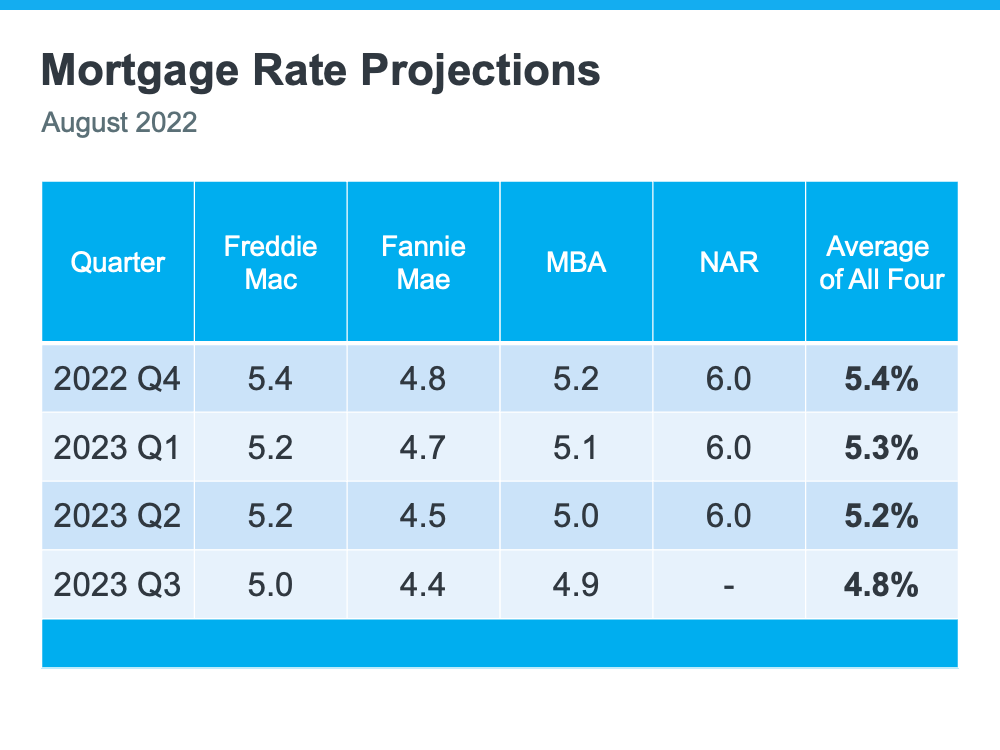

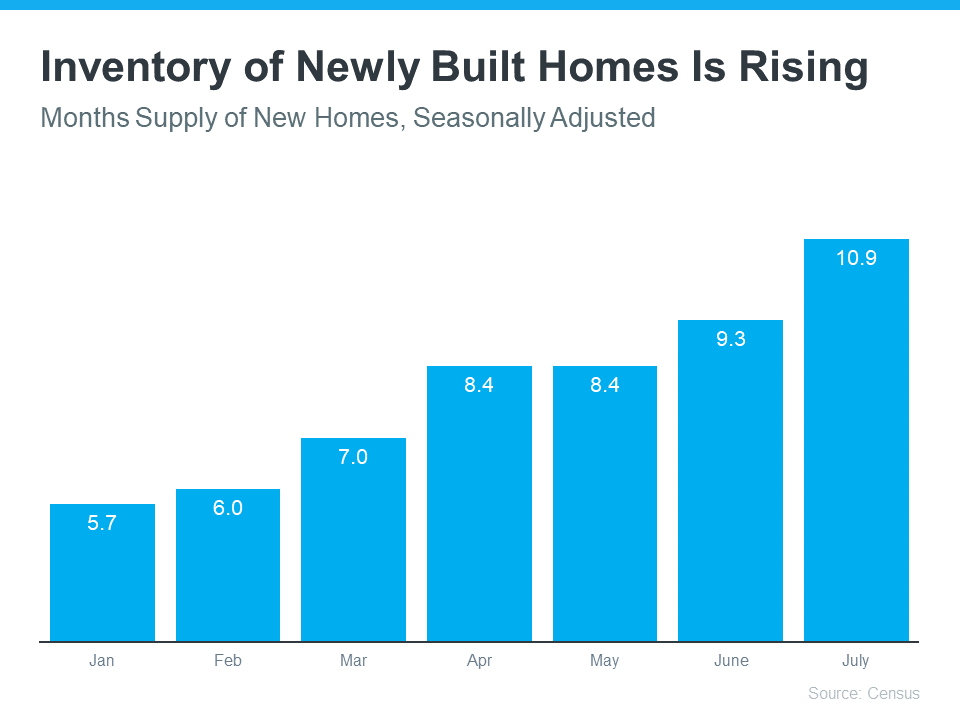

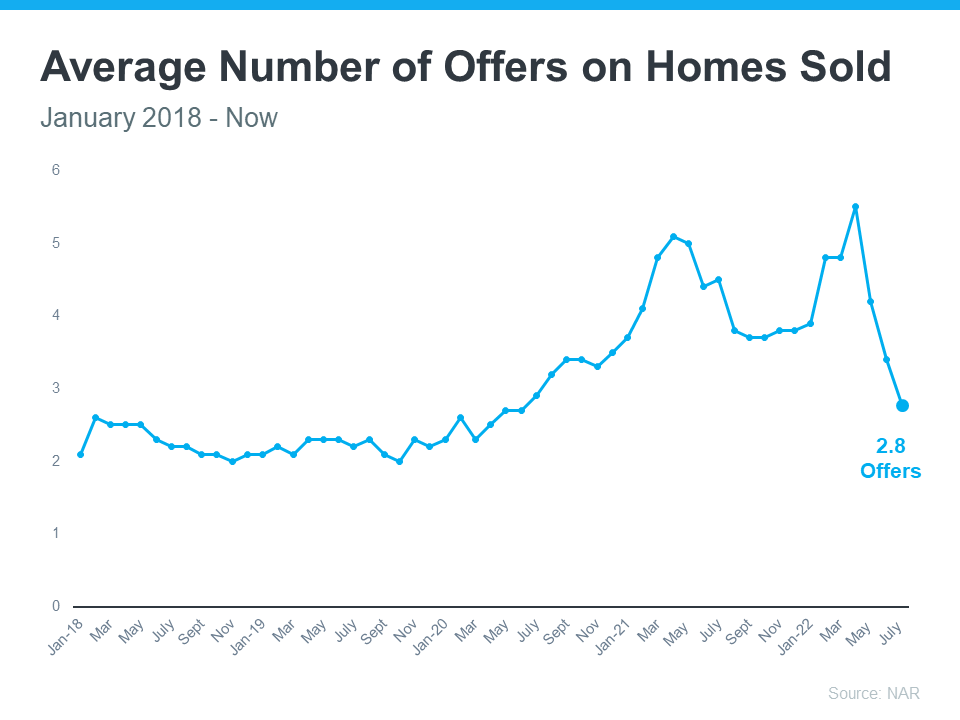

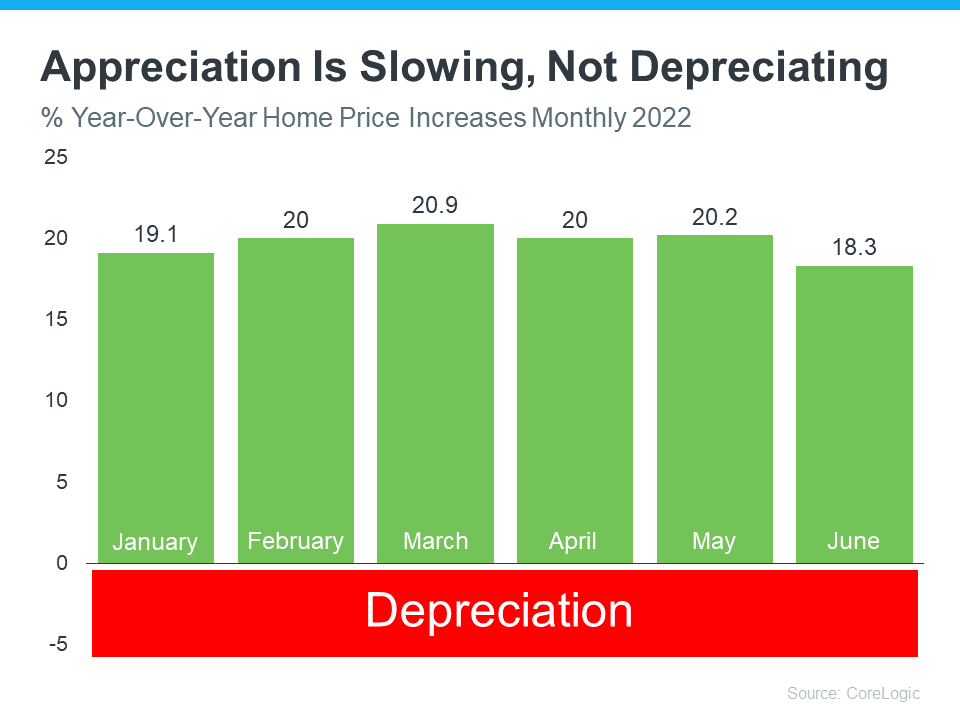

Equity is the current value of your home minus what you owe on the loan. Because there was a significant imbalance between the number of homes available for sale and the number of buyers looking to make a purchase over the past few years, home prices appreciated substantially. And while rising inventory and mortgage rates have cooled the market some in recent months, home prices nationally remain strong.

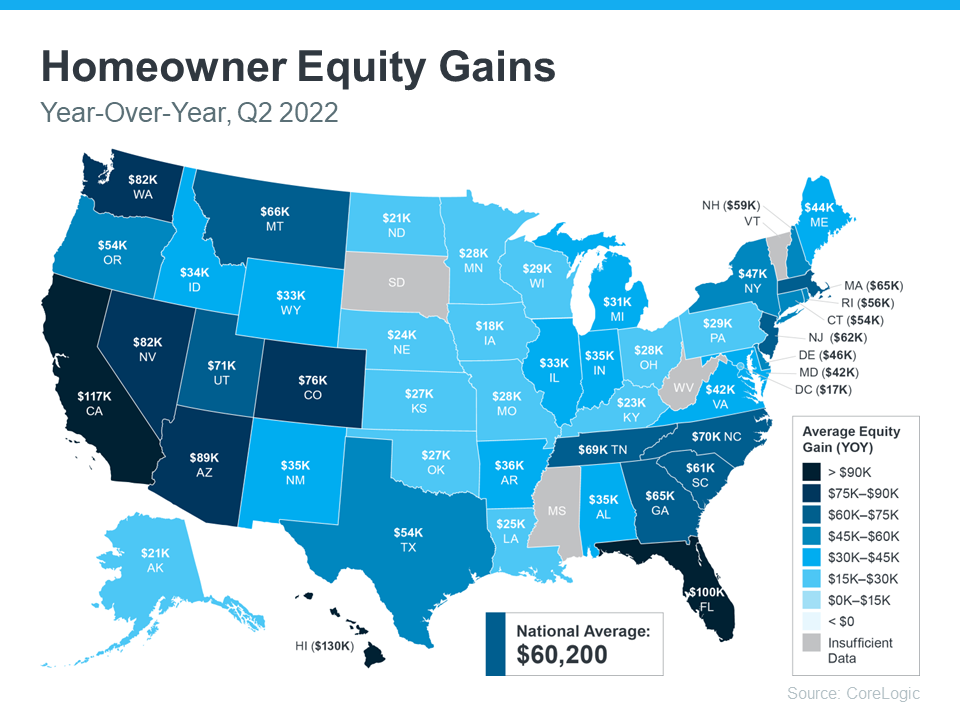

That’s why, according to the latest Homeowner Equity Insights from CoreLogic, the average homeowner equity has grown by $60,000 over the last 12 months. While that’s the national number, if you want to know what happened, on average, over the past year in your area, look at the map below from CoreLogic:

Why This Is So Important Right Now

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), helps explain why this matters so much today:

“. . . the decline in the stock market has dented overall net wealth. It has fallen by $6 trillion from the first to the second quarter. Only housing wealth has held on, with homeowners’ real estate wealth (home value minus mortgage balance) rising by $1.2 trillion.”

While equity helps increase your overall net worth, it can also help you achieve other goals like buying your next home. When you sell your current house, the equity you built up comes back to you in the sale, and it may be just what you need to cover a large portion – if not all – of the down payment on your next home.

Bottom Line

There’s volatility in today’s stock market, but home equity is still incredibly strong. To find out just how much equity you have in your current home, let’s connect.

![Here's Why It's Still a Sellers' Market [INFOGRAPHIC] | Simplifying The Market](https://allavenuerealty.com/wp-content/uploads/2022/09/20220902-KCM-Share-549x300-1.png)

![Here's Why It's Still a Sellers' Market [INFOGRAPHIC] | Simplifying The Market](https://allavenuerealty.com/wp-content/uploads/2022/09/20220902-MEM.png)

Follow Us!