Why Home Prices Keep Going Up

If you’ve ever dreamed of buying your own place, or selling your current house to upgrade, you’re no stranger to the rollercoaster of emotions changing home prices can stir up. It’s a tale of financial goals, doubts, and a dash of anxiety that many have been through.

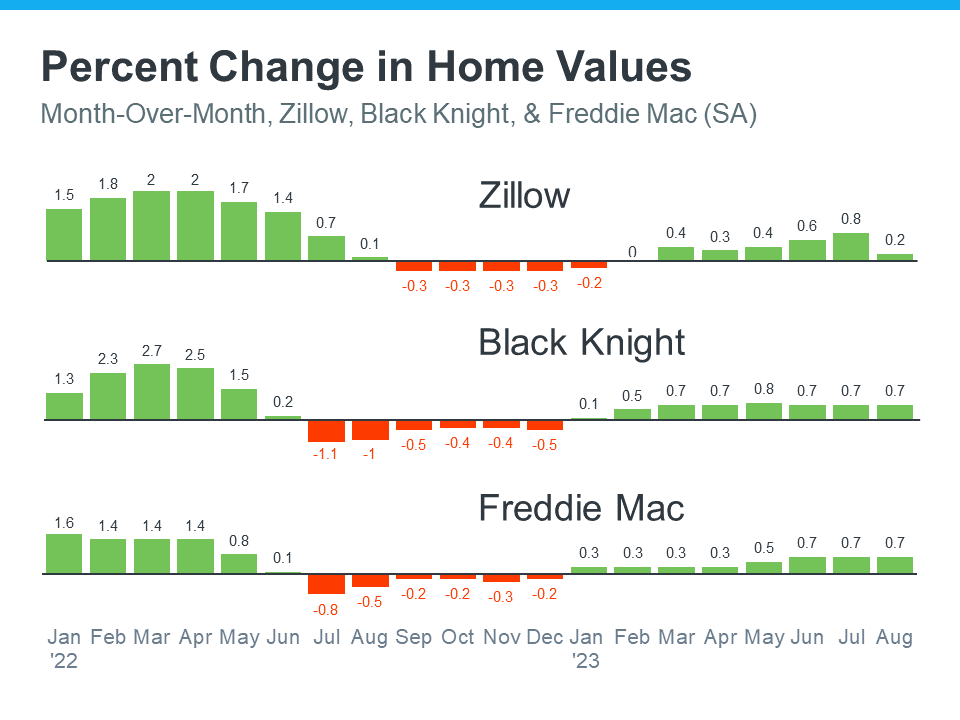

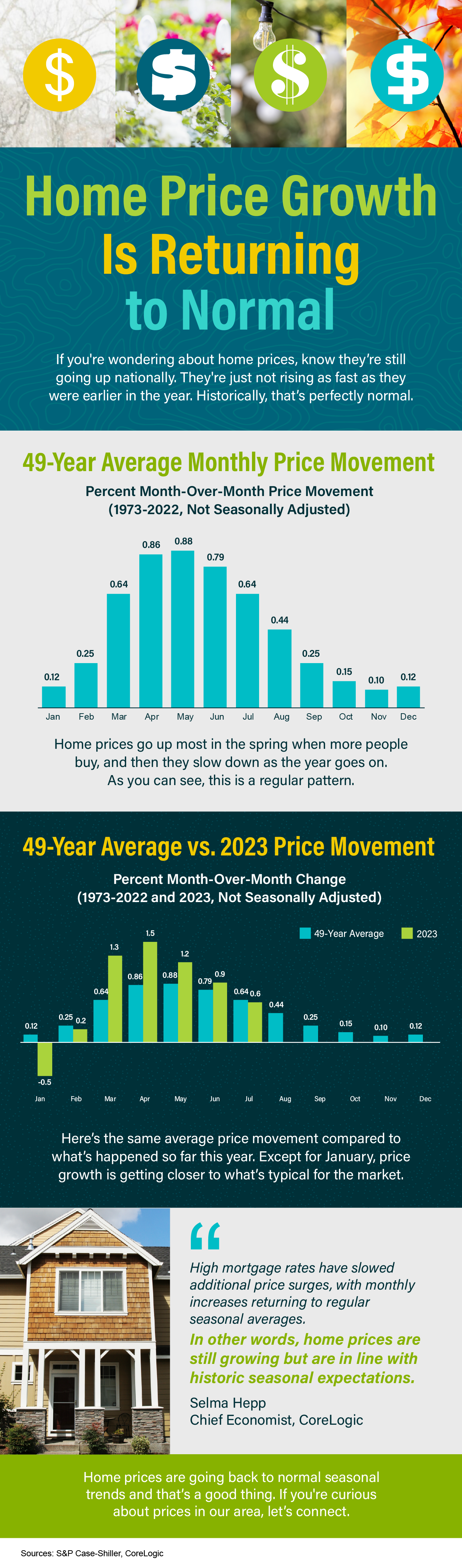

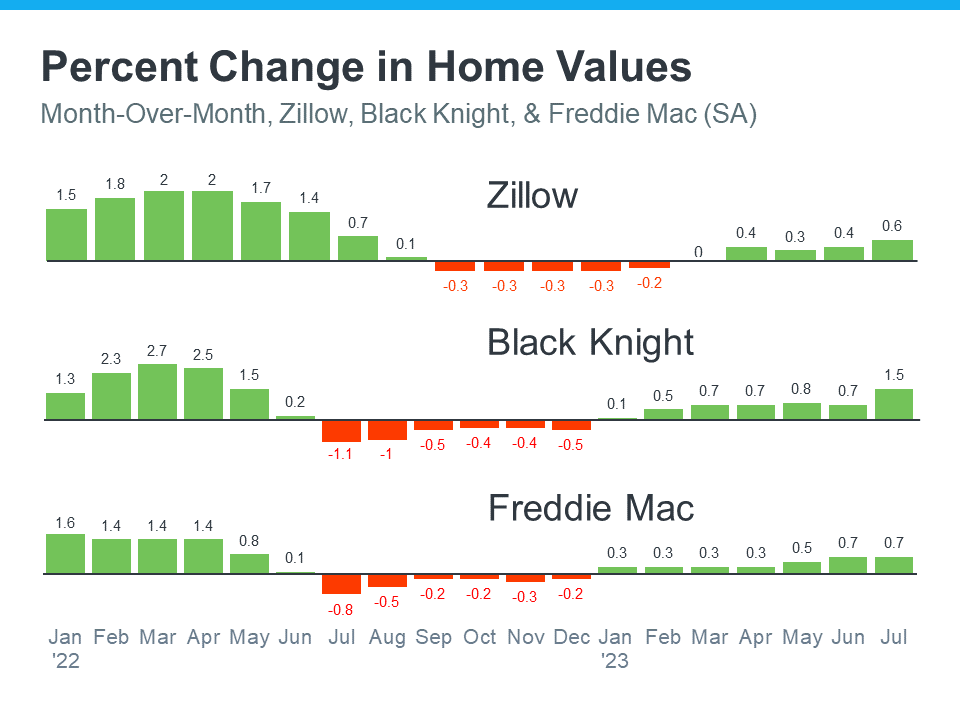

But if you put off moving because you’re worried home prices might drop, make no mistake, they’re not going down. In fact, it’s just the opposite. National data from several sources says they’ve been going up consistently this year (see graph below):

Here’s what this graph shows. In the first half of 2022, home prices rose significantly (the green bars on the left side of the graphs above). Those increases were dramatic and unsustainable.

So, in the second half of the year, prices went through a correction and started dipping a bit (shown in red). But those slight declines were shallow and short-lived. Still, the media really focused on those drops in their headlines – and that created a lot of fear and uncertainty among consumers.

But here’s what hasn’t been covered fully. So far in 2023, prices are going up once more, but this time at a more normal pace (the green bars on the right side of the graphs above). And after price gains that were too high and then the corrections that followed in 2022, the fact that all three reports show more normal or typical price appreciation this year is good news for the housing market.

Orphe Divounguy, Senior Economist at Zillow, explains changing home prices over the past 12 months this way:

“The U.S. housing market has surged over the past year after a temporary hiccup from July 2022-January 2023. . . . That downturn has proven to be short lived as housing has rebounded impressively so far in 2023. . .”

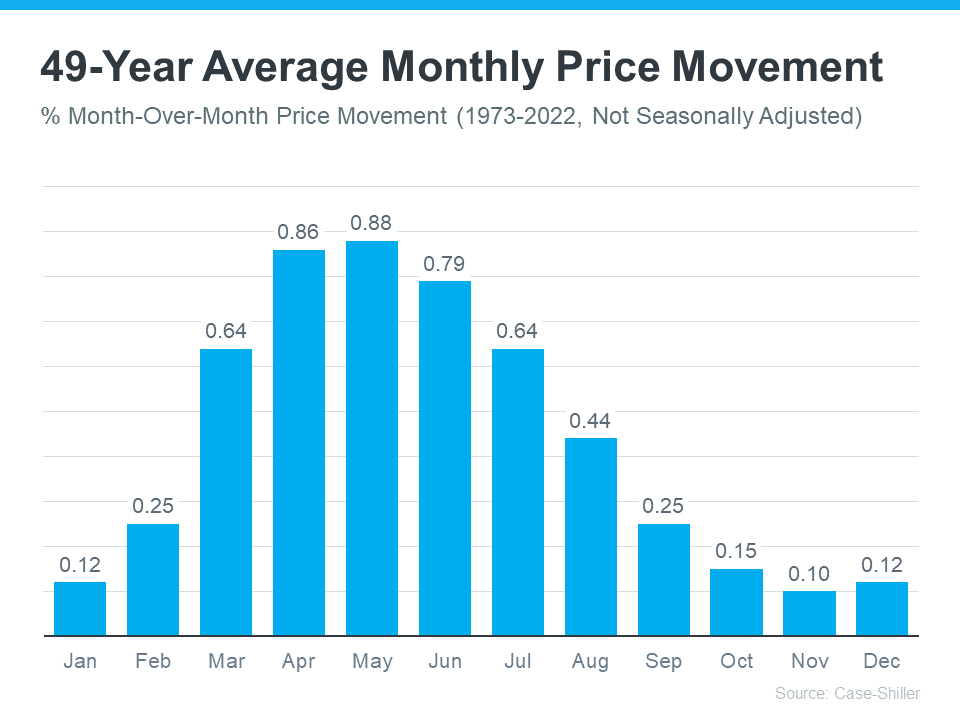

Looking ahead, home price appreciation typically starts to ease up this time of year. As that happens, there’s some risk the media will confuse slowing price growth (deceleration of appreciation) with home prices falling (depreciation). Don’t be fooled. Slower price growth is still growth.

Why Are Home Prices Increasing Now?

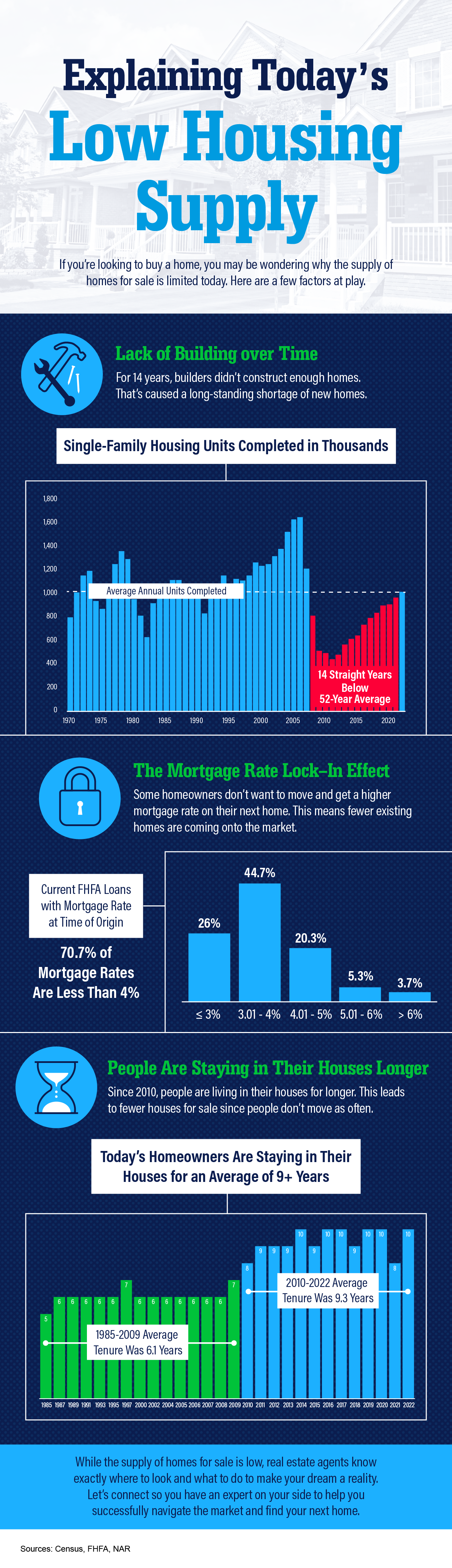

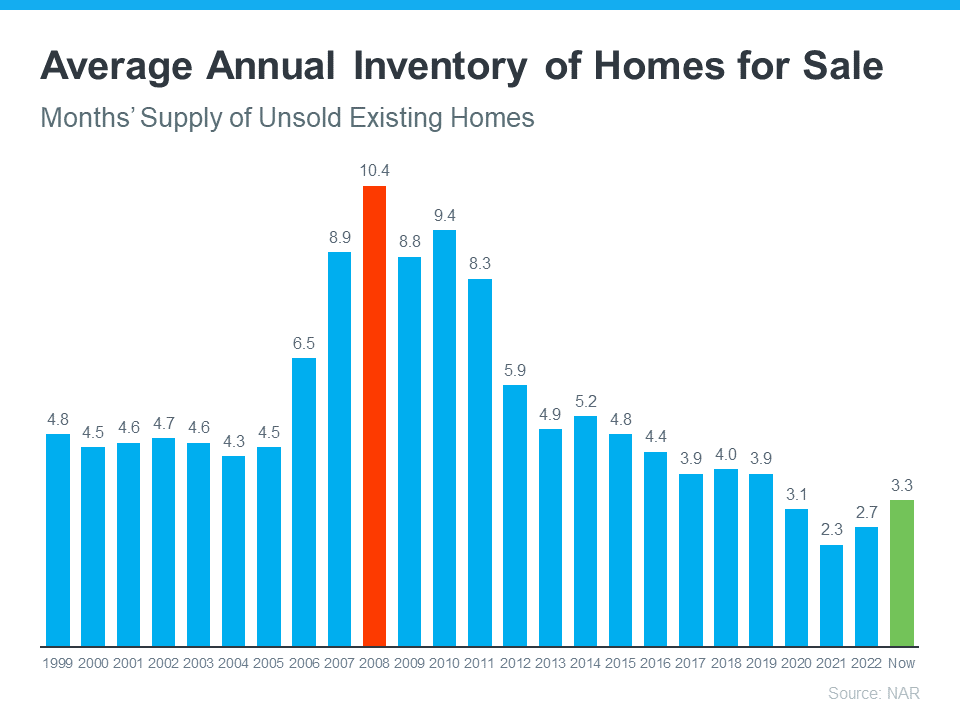

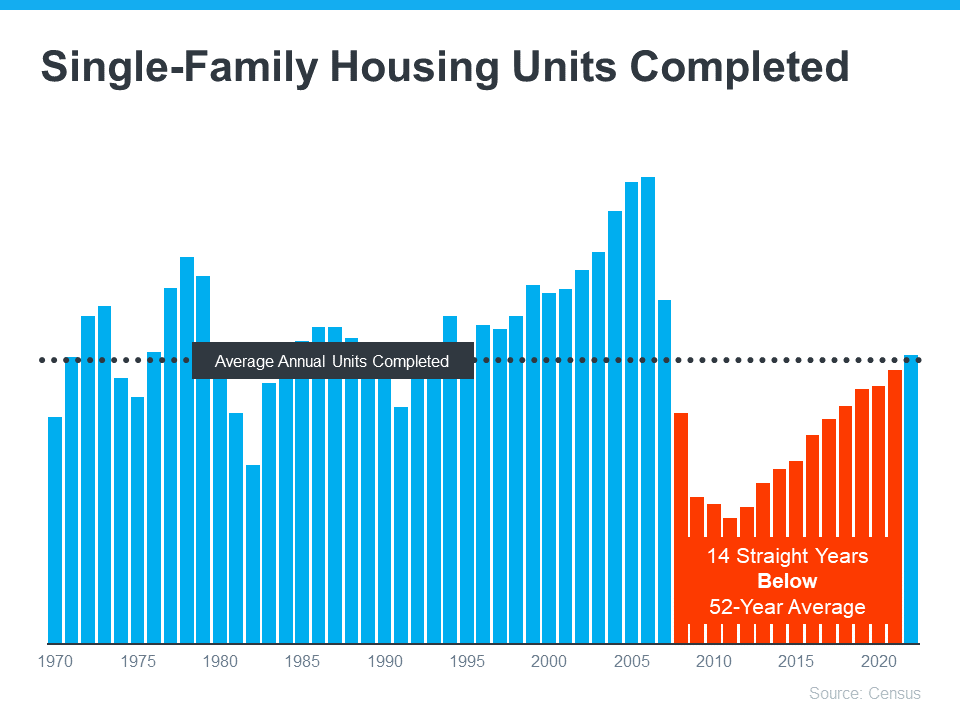

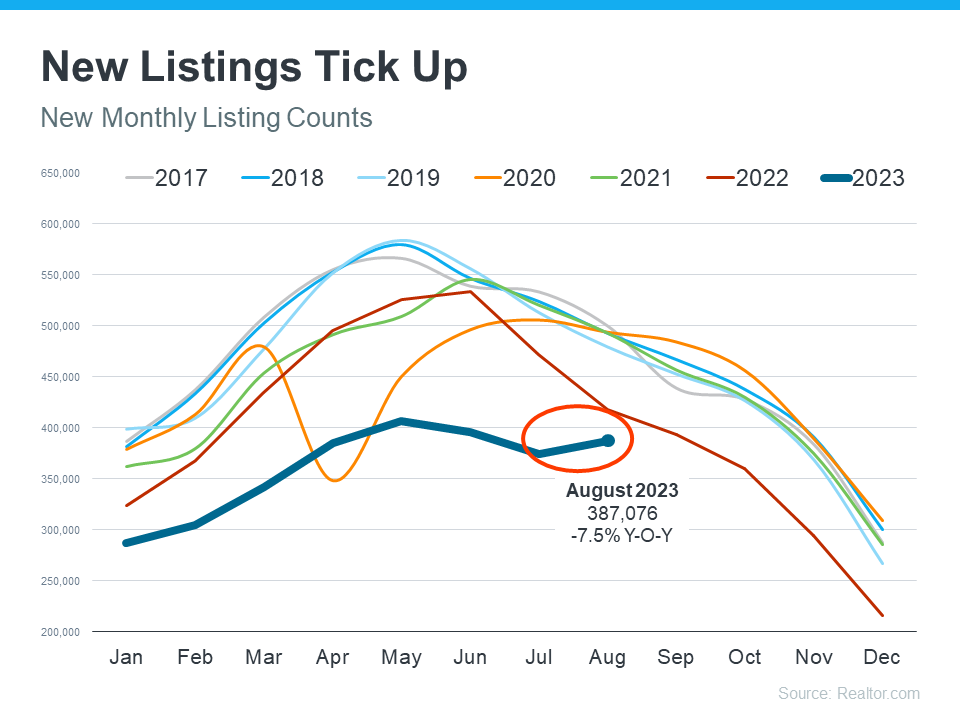

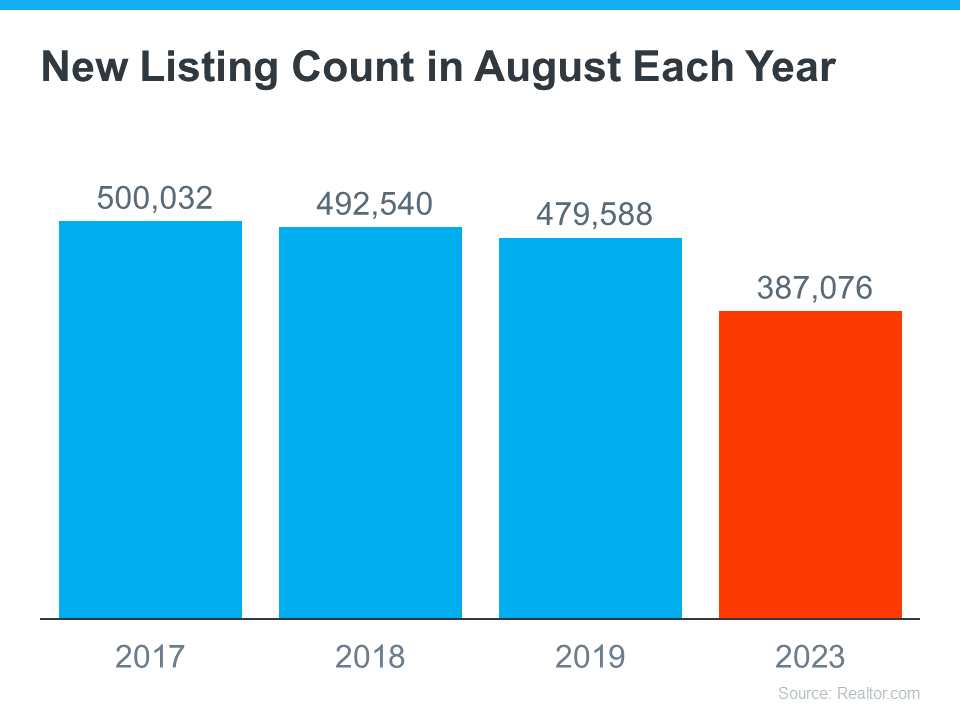

One reason why home prices are going back up is because there still aren’t enough homes for sale for all the people who want to buy them.

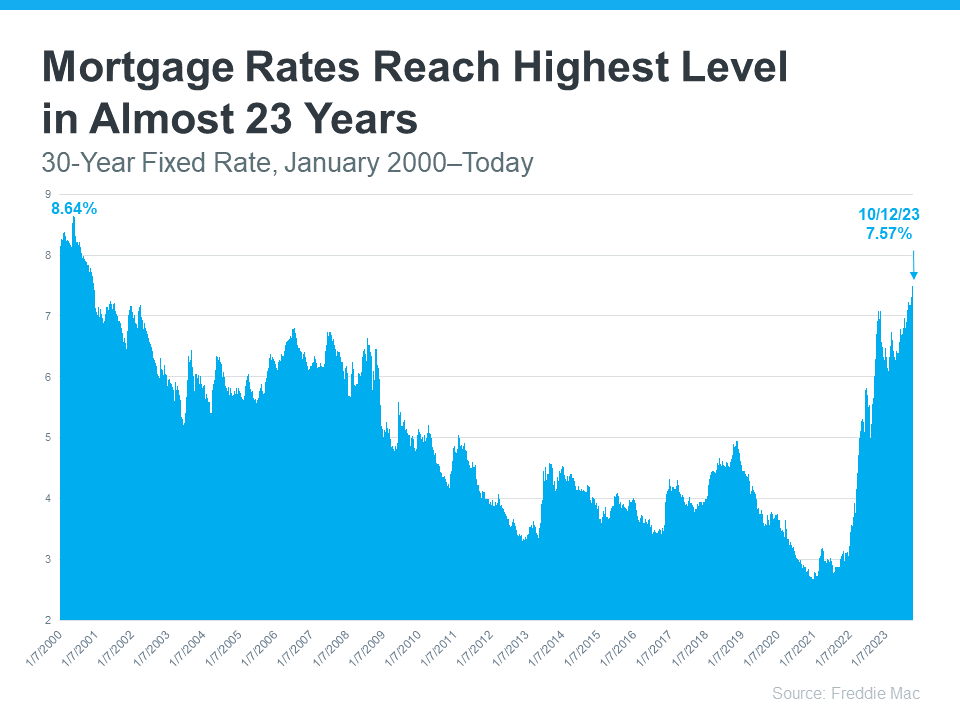

Even though higher mortgage rates cause buyer demand to moderate, they also cause the supply of available homes to go down. That’s because of the mortgage rate lock-in effect. When rates rise, some homeowners are reluctant to sell and lose their current low mortgage rate just to take on a higher one for their next home.

So, with higher mortgage rates impacting both buyers and sellers, the supply and demand equation of the housing market has been affected. But since there are still more people who want to purchase homes than there are homes available to buy, prices continue to rise. As Freddie Mac states:

“While rising interest rates have reduced affordability—and therefore demand—they have also reduced supply through the mortgage rate lock-in effect. Overall, it appears the reduction in supply has outweighed the decrease in demand, thus house prices have started to increase . . .”

Here’s How This Impacts You

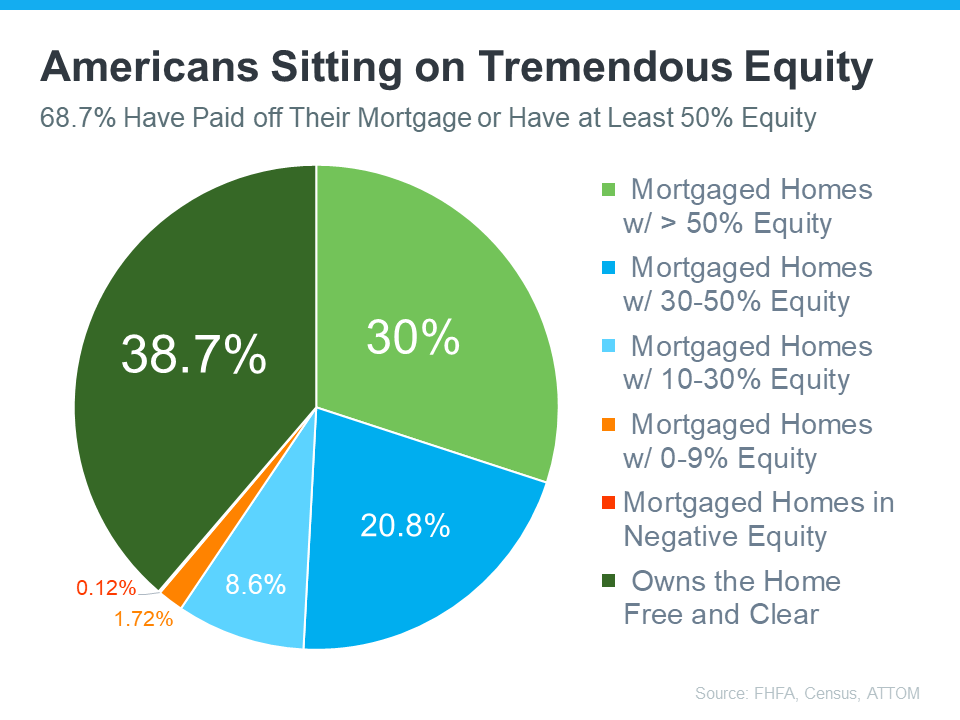

- Buyers: If you’ve been waiting to buy a home because you were afraid its value might drop, knowing that home prices have gone back up should make you feel better. Buying a home gives you a chance to own something that usually becomes more valuable over time.

- Sellers: If you’ve been holding off on selling your house because you were worried about how changing home prices would impact its value, it could be a smart move to work with a real estate agent and put your house on the market. You don’t have to wait any longer because the most recent data indicates home prices have turned in your favor.

Bottom Line

If you put off moving because you were worried that home prices might go down, data shows they’re increasing across the country. Work with a local real estate agent to understand how home prices are changing in your local area.

![Home Price Growth Is Returning to Normal [INFOGRAPHIC] Simplifying The Market](https://allavenuerealty.com/wp-content/uploads/2023/10/Home-Price-Growth-Is-Returning-To-Normal-KCM-Share.png)

![Explaining Today’s Low Housing Supply [INFOGRAPHIC] Simplifying The Market](https://allavenuerealty.com/wp-content/uploads/2023/09/Explaining-Todays-Low-Housing-Supply-KCM-Share.png)

Follow Us!